Real estate investing is one of the most powerful ways to build long-term wealth, but securing financing can often be the biggest hurdle. Traditional mortgage lenders scrutinize personal income, tax returns, and debt-to-income (DTI) ratios, making it difficult for:

❌ Self-employed individuals with fluctuating income

❌ Investors with multiple properties hitting loan limits

❌ Those buying under an LLC for asset protection

If you’ve faced these roadblocks, a Debt-Service Coverage Ratio (DSCR) loan could be the key to scaling your portfolio faster and removing financing limitations.

Unlike traditional mortgages, DSCR loans focus on the rental income of the property—not your personal income. This means you can qualify without tax returns, W-2s, or employment verification.

In this guide, we’ll cover:

✅ How to qualify for a DSCR loan

✅ Lender requirements and insider approval tips

✅ Common pitfalls to avoid

✅ How to strategically use DSCR loans to expand your portfolio

If you’re serious about becoming a full-time investor or scaling up your rental business, DSCR loans are a game-changer. Let’s dive in!

Step 1: Understand What DSCR Lenders Look For

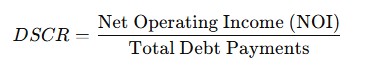

Lenders base DSCR loan approval on one simple metric: the Debt-Service Coverage Ratio (DSCR).

🔹 The DSCR Formula:

Where:

- Net Operating Income (NOI) = Monthly rental income (actual or projected)

- Total Debt Payments = Monthly mortgage payment (PITI: Principal, Interest, Taxes, and Insurance)

Example: A Property with a Strong DSCR

- Monthly Rental Income: $5,000

- Mortgage Payment (PITI): $4,000

- DSCR Calculation:

5,000÷4,000=1.255,000 \div 4,000 = 1.255,000÷4,000=1.25

✅ DSCR = 1.25 (Lender-friendly! The property earns 25% more than the mortgage payment.)

🔹 Lender Standards for DSCR:

Below 1.0 ❌ (Risky – May require a larger down payment).25, meaning the property must generate at least 100%–125% of the mortgage payment in rental income.

1.25+ ✅ (Excellent – Best approval odds)

1.0 – 1.24 ⚠️ (Acceptable – May require higher reserves)

Step 2: Meeting the Key DSCR Loan Requirements

✔ Credit Score Requirements

Lenders still check credit, even though personal income isn’t considered.

- 700+ = Best interest rates & easiest approval

- 660 – 699 = Higher rates may apply

- 620 – 659 = Limited lender options, stricter terms

🔹 Insider Tip: Keep credit utilization under 30% and avoid opening new loans before applying.

✔ Down Payment & Loan-to-Value (LTV) Ratios

- 20-25% down ✅ (Standard for DSCR loans)

- 15% down ⚠️ (Possible with high DSCR & strong credit)

- 30%+ down ❌ (Required for high-risk loans or low DSCR properties)

🔹 Example:

A $300,000 rental property would typically require $60,000 – $75,000 down (20-25%).

✔ Cash Reserves Requirement

Lenders want to see that you can cover unexpected vacancies.

- 6 months of reserves (Most lenders require this)

- 12 months for riskier deals (Lower DSCR or credit may require more reserves)

🔹 Example:

If your mortgage is $2,500/month, you’ll need at least $15,000 in reserves.

Step 3: Preparing Your Loan Application

Because DSCR loans don’t require W-2s or tax returns, your focus should be on proving the property’s income potential.

✔ Lease agreements (if property is occupied)

✔ Appraisal report (to confirm rental value)

✔ Bank statements (to verify reserves)

✔ LLC documents (if buying under a business entity)

🔹 Pro Tip: If the property is vacant, lenders will use market rent projections from an appraiser.

Step 4: Common Mistakes to Avoid When Applying

🚫 1. Underestimating DSCR Requirements

- If your DSCR is too low, increase rent or make a higher down payment.

🚫 2. Not Having Enough Reserves

- Ensure you have at least 6-12 months of mortgage payments in savings.

🚫 3. Choosing the Wrong Property Type

- Some lenders won’t finance fixer-uppers or mixed-use properties.

🚫 4. Skipping the Pre-Approval Process

- Getting pre-approved first strengthens your position when making offers.

How Investors Use DSCR Loans to Expand Faster

DSCR loans open the door to faster portfolio growth by removing the personal income verification requirement and focusing purely on property cash flow. Investors who understand how to leverage rental income, refinance equity, and reinvest strategically can grow at a much quicker pace than those using traditional financing.

Here are two real-world examples of how investors successfully use DSCR loans to scale.

Example 1: First-Time Investor Scaling Up

🔹 Maria’s Story: Turning One Rental Property Into Multiple Investments

Maria is a self-employed graphic designer who wants to start investing in real estate. Since her income fluctuates from month to month, traditional banks won’t approve her for a conventional mortgage. She discovers DSCR loans, which allow her to qualify without W-2s or tax returns.

Phase 1: Buying the First Rental Property

- Maria purchases a $250,000 single-family rental with 20% down ($50,000).

- Her monthly rental income is $2,200, and her mortgage payment (PITI) is $1,750.

- Her DSCR is 1.26—high enough to qualify for a DSCR loan.

- Within six months, her property appreciates to $280,000 while generating steady cash flow.

Phase 2: Refinancing to Extract Equity

- Maria refinances with a DSCR cash-out loan, pulling $30,000 in equity.

- Since her property value increased and her rental income remained strong, the lender approves the refinance without checking her personal income.

- She now has extra capital to reinvest.

Phase 3: Repeating the Process

- Maria uses the $30,000 as part of the down payment on another rental.

- She repeats this every 6–12 months, acquiring a new property with each refinance.

- Within four years, she owns four cash-flowing rentals, all financed with DSCR loans.

🚀 Key Takeaway: By leveraging DSCR loans and strategic refinancing, Maria was able to multiply her initial investment into multiple properties without ever using personal income verification.

Example 2: Experienced Investor Expanding a Portfolio

🔹 Tom’s Story: Scaling Beyond Traditional Loan Limits

Tom is a seasoned real estate investor with 10+ rental properties. He has strong cash flow, but because he already has multiple mortgages, banks won’t approve him for additional loans due to DTI restrictions.

Phase 1: Hitting the Traditional Loan Wall

- Tom earns $150,000 per year but already has $1.2 million in mortgage debt across his portfolio.

- Even though his rental income covers all expenses, traditional lenders deny him for new loans due to his DTI ratio.

Phase 2: Switching to DSCR Loans

- Tom switches to DSCR loans, which don’t consider his personal debt or income.

- Since each property qualifies on its own cash flow, he can continue acquiring rentals without worrying about his personal DTI.

- He immediately purchases two more multi-unit properties, each with a DSCR of 1.3+.

Phase 3: Leveraging Portfolio Loans

- After growing his portfolio to 15+ properties, Tom consolidates multiple DSCR loans into a single portfolio loan, reducing administrative costs and getting better terms.

- He continues to scale aggressively, adding properties every 6-12 months.

- Now, instead of being limited by his personal income, his rental properties fund his entire real estate business.

🚀 Key Takeaway: Tom used DSCR loans to eliminate DTI restrictions, allowing him to continue growing his portfolio without financing limitations.

Additional Strategies for Scaling with DSCR Loans

Beyond simple refinancing, investors can maximize DSCR loans using these advanced strategies:

1. Cash-Out Refinancing for Faster Growth

- After 6-12 months, investors can refinance a rental property to pull out equity.

- The cash can be used as a down payment for another investment.

- This is how many investors turn one property into multiple properties.

2. Using Short-Term Rentals for Higher DSCR Ratios

- Some lenders allow short-term rental income (Airbnb, VRBO) to count toward DSCR calculations.

- Since STRs often generate 2-3x higher rents than long-term leases, they easily qualify for DSCR loans.

- Investors can maximize returns and qualify for larger loans.

3. Portfolio Loans for Large-Scale Investors

- Once an investor owns multiple properties, they can bundle them into one loan to simplify payments.

- Portfolio loans lower interest rates and streamline management.

- This is a powerful tool for high-volume investors.

Final Thoughts: How DSCR Loans Help You Build Long-Term Wealth

DSCR loans remove the biggest barriers to real estate investing by allowing investors to qualify based on property cash flow—not personal income.

🔹 Why Investors Love DSCR Loans:

✔ No W-2s, tax returns, or job verification required

✔ Faster approvals and closings (less paperwork)

✔ No limit on the number of properties financed

✔ LLC ownership allowed (for asset protection)

✔ Works for long-term rentals, multi-units, and short-term Airbnb properties

If you’re a first-time investor looking to start, or an experienced landlord ready to scale, DSCR loans offer the fastest path to building a thriving rental portfolio.

📞 Ready to Expand Your Portfolio? Get Pre-Approved Today!

At First Nation Financial, we specialize in helping real estate investors secure DSCR loans with:

✔ Competitive rates 💰

✔ Fast approvals (2-3 weeks) ⚡

✔ Expert guidance to help you scale 🏡

🔹 Contact us today to start growing your investment portfolio! 🚀