The Challenge of Traditional Financing for Investors

For real estate investors, securing financing is often the biggest hurdle when scaling their rental property portfolios. Traditional mortgage lenders require extensive income documentation—W-2s, tax returns, and proof of employment—which can be a roadblock for self-employed individuals or investors with complex financial situations.

But what if you could qualify for a loan without verifying your personal income? That’s exactly what Debt-Service Coverage Ratio (DSCR) loans allow you to do.

DSCR loans focus on a property’s income potential rather than the borrower’s personal income, making them an ideal solution for real estate investors looking to expand their portfolio without traditional income verification.

In this guide, we’ll explore:

✅ What DSCR loans are and how they work

✅ Who qualifies for a DSCR loan

✅ Step-by-step guide to securing a DSCR loan

✅ Pros and cons compared to traditional financing

✅ How First Nation Financial can help you get started

If you’re serious about growing your real estate investments, this loan type could be your game-changer.

What Is a DSCR Loan?

I+nstead of looking at a borrower’s personal debt-to-income ratio (DTI), lenders use the Debt-Service Coverage Ratio (DSCR) to determine loan eligibility.

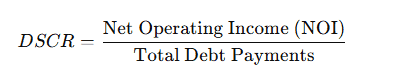

👉 The DSCR Formula:

Where:

- Net Operating Income (NOI) = Monthly rental income (or projected rent for vacant properties)

- Total Debt Payments = Monthly mortgage payment (PITI: Principal, Interest, Taxes, and Insurance)

Example 1: Standard Rental Property

- Monthly Rental Income: $5,000

- Mortgage Payment (PITI): $4,000

- DSCR Calculation:

5,000÷4,000=1.255,000 \div 4,000 = 1.255,000÷4,000=1.25

✅ DSCR = 1.25 (Good! This means the property generates 25% more income than needed to cover the loan payment.)

Example 2: Property With a Lower DSCR

- Monthly Rental Income: $3,500

- Mortgage Payment (PITI): $4,000

- DSCR Calculation:

3,500÷4,000=0.883,500 \div 4,000 = 0.883,500÷4,000=0.88

🚨 DSCR = 0.88 (Risky! The property doesn’t generate enough rental income to cover the mortgage.)

👉 Many lenders require a minimum DSCR of 1.0 to 1.25 to approve a loan. However, some lenders accept lower DSCRs (even 0.75) if the borrower has strong reserves or a large down payment.

Comparing DSCR Loans vs. Traditional Loans

| Feature | DSCR Loan | Traditional Loan |

|---|---|---|

| Income Verification | No personal income verification | Requires W-2s, tax returns, and pay stubs |

| Debt-to-Income (DTI) Ratio | Not considered | Must meet strict DTI limits |

| Approval Speed | Faster (focuses only on property income) | Slower due to full financial review |

| Property Qualification | Based on rental income | Based on borrower’s personal finances |

| Who It’s Best For | Investors, self-employed, LLC buyers | Homeowners with stable W-2 income |

📌 Key Takeaway: If you’re a real estate investor, DSCR loans simplify the approval process by removing personal income documentation requirements.

Why Lenders Care About DSCR

Lenders use DSCR as a risk assessment tool. A higher DSCR signals:

✔ The property is profitable and can cover the mortgage without relying on the investor’s income.

✔ Lower risk for the lender, since the rental income provides a cushion against payment defaults.

Lender Standards for DSCR:

- 1.25+ = Excellent (Most lenders approve without issue)

- 1.0 – 1.24 = Acceptable (Some lenders may require stronger credit or reserves)

- Below 1.0 = Risky (Only a few lenders approve, often with higher rates)

Some lenders accept a DSCR below 1.0 if the borrower has strong cash reserves, high credit, or a larger down payment.

Can You Use a DSCR Loan for Airbnb and Short-Term Rentals?

Yes! Many lenders allow Airbnb and VRBO properties to qualify for DSCR loans. However, there are some key differences:

✔ Some lenders use long-term lease estimates instead of short-term rental income.

✔ Other lenders accept STR projections based on Airbnb rental history or third-party rental reports.

✔ Vacation rental properties may require a higher DSCR (e.g., 1.5 instead of 1.25).

🔗 Related: Understanding Adjustable-Rate Mortgages (ARMs) (If you want lower rates with flexible payments)

Thoughts on DSCR Loans

A DSCR loan is one of the best tools for investors looking to scale their portfolio without the headaches of proving personal income.

🏡 It’s ideal for:

✔ Investors wanting to buy rental properties through an LLC

✔ Self-employed individuals with fluctuating income

✔ Seasoned landlords who own multiple properties

✔ First-time investors who don’t have W-2 income

Want to know if your property qualifies? Contact First Nation Financial today for expert guidance.

📞 Get Pre-Approved & Start Growing Your Portfolio! 🚀

Why DSCR Loans Are a Game-Changer for Real Estate Investors

For real estate investors, securing financing can be a major obstacle when scaling a rental portfolio. Traditional loans rely heavily on personal income, which can be a roadblock for:

- Self-employed investors with fluctuating income

- Investors with multiple properties who exceed debt-to-income (DTI) limits

- Buyers using LLCs or corporations instead of personal names

This is where Debt-Service Coverage Ratio (DSCR) loans change the game—they let investors qualify based on property income alone, making the process faster, easier, and more scalable.

Key Benefits of DSCR Loans for Investors

✅ 1. No Personal Income Verification Needed

Traditional loans require:

❌ W-2s, pay stubs, and tax returns

❌ Employment verification

❌ Proof of steady income

With a DSCR loan, none of this is needed. Lenders only care about:

✔ The property’s rental income

✔ The property’s DSCR ratio (Is the rent enough to cover the mortgage?)

🔹 Example:

- John, a self-employed investor, owns a marketing agency.

- His tax returns show fluctuating income, making it hard to qualify for a traditional loan.

- With a DSCR loan, his business income doesn’t matter—only the rental income of the property does.

- He gets approved easily without submitting tax returns.

🔗 Related: A Guide to Achieving Homeownership with First Nation Financial (If you’re a first-time investor exploring financing options)

✅ 2. Faster & Easier Loan Approval

Traditional mortgage applications require deep financial reviews, leading to weeks of underwriting delays. DSCR loans speed up the process because:

✔ Lenders only review the property’s income (not your job, salary, or taxes)

✔ Less paperwork = faster approval (closings in as little as 2-3 weeks)

✔ No debt-to-income (DTI) restrictions (so you can scale faster)

🔹 Example:

- Sarah, an experienced investor, wants to buy two rental properties at once.

- Traditional lenders would limit her based on her personal income & DTI.

- With DSCR loans, she buys both properties with zero personal income verification and closes in just 3 weeks.

🔗 Related: Why Houston and California Are Great Homeownership Markets (For investors targeting these locations)

✅ 3. No Limit on Number of Properties Financed

Most conventional loans limit investors to financing a maximum of 10 properties before requiring commercial financing.

With DSCR loans:

✔ No cap on the number of properties financed

✔ Perfect for scaling large rental portfolios

✔ Investors can purchase multiple properties at the same time

🔹 Example:

- Mike already owns 10+ rental properties and banks won’t approve him for more loans.

- A DSCR lender doesn’t care how many properties he owns—as long as each property’s rental income covers the mortgage, he can keep buying.

- He expands his portfolio with unlimited DSCR financing.

✅ 4. Allows LLC or Corporate Ownership

Many real estate investors prefer to buy properties under an LLC or corporation for:

✔ Asset protection (to separate personal & business assets)

✔ Tax benefits (LLC-owned rentals have unique deductions)

✔ Easier portfolio management

Unlike conventional loans (which typically require personal ownership), DSCR loans allow investors to purchase properties under an LLC.

🔹 Example:

- Lisa flips and rents properties under her LLC for liability protection.

- A traditional loan would require her to buy under her personal name—risking her assets.

- A DSCR loan lets her purchase rental properties through her LLC while keeping her personal finances separate.

✅ 5. Flexibility for Property Types (Short-Term Rentals, Multi-Units, & More)

DSCR loans work for:

✔ Single-family homes

✔ Multi-family (2-4 units)

✔ Condos & townhomes

✔ Vacation rentals (Airbnb & VRBO)

✔ Mixed-use properties

🏡 Short-Term Rentals & Airbnb-Friendly DSCR Loans

Some lenders allow projected short-term rental income to qualify—perfect for Airbnb investors.

However, requirements differ:

✔ Some lenders require 12+ months of rental history

✔ Others use market rental estimates

✔ DSCR requirements may be higher for short-term rentals (1.5+ DSCR instead of 1.25)

🔗 Related: Understanding Adjustable-Rate Mortgages (ARMs) (If you want to explore loan options with lower interest rates)

DSCR Loans vs. Other Investor Loan Options

| Feature | DSCR Loan | Traditional Loan | Bank Statement Loan | Asset-Based Loan |

|---|---|---|---|---|

| Income Verification | None (rental income only) | W-2s & Tax Returns | 12-24 months bank statements | None (net worth-based) |

| Debt-to-Income Ratio | Not considered | Must be under 43-50% | Not considered | Not considered |

| Property Ownership | LLC or personal | Personal only | Personal only | LLC or personal |

| Best For | Buy-and-hold rental investors | Homeowners & W-2 borrowers | Self-employed borrowers | High-net-worth investors |

| Approval Speed | Fast (2-3 weeks) | Slow (4-6 weeks) | Moderate (3-4 weeks) | Fast (2-3 weeks) |

📌 Key Takeaway: If you’re an investor focusing on rental properties, a DSCR loan is your best option for flexible, scalable financing.

Who Should Use a DSCR Loan?

DSCR loans are best for:

🏡 New investors who want to buy rentals without proving W-2 income

🏡 Seasoned investors scaling a portfolio past 10+ properties

🏡 Self-employed borrowers who don’t have traditional tax returns

🏡 Short-term rental investors (Airbnb, VRBO) who need alternative financing

🏡 LLC or corporate buyers who want asset protection

If you fall into any of these categories, a DSCR loan is likely the best path to growing your real estate business.

How to Qualify for a DSCR Loan

One of the biggest advantages of DSCR loans is their simplified qualification process compared to traditional mortgages. Since lenders focus only on the property’s income, approval is faster and more flexible—but you still need to meet key lender criteria.

Here’s what lenders look for when approving a DSCR loan:

1. Debt-Service Coverage Ratio (DSCR) Requirement

The most important factor in qualifying for a DSCR loan is the property’s DSCR score—which shows whether the rental income can cover the mortgage payment.

🔹 Lender Standards for DSCR:

- 1.25+ ✅ (Excellent) – Strong rental income, easiest approval

- 1.0 – 1.24 ⚠️ (Acceptable) – Some lenders may require a higher down payment

- Below 1.0 ❌ (Risky) – Most lenders won’t approve unless you have strong reserves

How to Improve Your DSCR:

✔ Increase rent (furnished rentals or short-term rental strategy)

✔ Lower mortgage costs (higher down payment, shop for lower rates)

✔ Reduce property expenses (negotiate insurance, lower taxes if possible)

🔹 Example:

- If a property has a DSCR of 1.1, you might get approved, but the lender could require more reserves or a slightly higher interest rate.

- If your DSCR is below 1.0, you may need a larger down payment or lower loan amount to get approved.

2. Minimum Credit Score

Even though DSCR loans don’t require personal income verification, lenders still check credit scores to assess borrower risk.

🔹 Lender Credit Score Requirements:

- 700+ ✅ (Best rates & terms)

- 660 – 699 ⚠️ (Still qualifies but may have higher rates)

- 620 – 659 ❌ (Limited lenders, higher rates, more reserves required)

How to Improve Your Credit Before Applying:

✔ Pay down credit card balances (aim for below 30% utilization)

✔ Avoid new hard inquiries (don’t open new loans or credit lines before applying)

✔ Correct errors on your credit report (dispute any inaccuracies)

3. Down Payment Requirements

DSCR loans usually require higher down payments than traditional loans.

🔹 Typical Down Payment Guidelines:

- 20-25% down ✅ (Standard requirement)

- 15% down ⚠️ (Possible with strong credit & DSCR over 1.25)

- 30%+ down 💰 (May be required for riskier deals or lower DSCR properties)

🔹 Example:

- A $300,000 property will typically require $60,000 – $75,000 down (20-25%).

- If the DSCR is below 1.0, the lender might ask for 30%+ down to reduce risk.

4. Cash Reserves Requirement

Lenders want to ensure borrowers can cover mortgage payments if the property becomes vacant.

🔹 Typical Reserve Requirements:

- 6 months of mortgage payments ✅ (Standard for most DSCR lenders)

- 12 months reserves ⚠️ (Required for lower credit scores or lower DSCR)

🔹 Example:

- If your monthly mortgage payment is $2,500, you’ll need $15,000 in reserves (6 months).

- If you have lower credit or a lower DSCR, some lenders will ask for 12 months of reserves.

5. Eligible Property Types

✔ Single-family homes (SFRs)

✔ Multi-family units (2-4 units)

✔ Condos & townhomes

✔ Short-term rentals (Airbnb, VRBO)

✔ Mixed-use properties (some lenders allow these)

🚫 Properties that may not qualify:

- Fixer-uppers needing major repairs

- Commercial properties (some exceptions for mixed-use)

- Owner-occupied properties (DSCR loans are for investment properties only)

🔹 Tip: If buying a property that needs minor repairs, consider a rehab-friendly DSCR lender who allows funds for renovations.

6. Loan-to-Value (LTV) Limits

Lenders base loans on a Loan-to-Value (LTV) ratio, which is the percentage of the property’s value you’re borrowing.

🔹 LTV Guidelines for DSCR Loans:

- 75-80% LTV ✅ (Standard, requires 20-25% down)

- 85% LTV ⚠️ (Available with strong DSCR & high credit)

- 65-70% LTV 💰 (For riskier deals or low DSCR properties)

Common Reasons DSCR Loans Get Denied (And How to Fix Them)

🔴 1. DSCR is too low – If the rent isn’t high enough to cover the mortgage, increase rent, lower loan amount, or put more money down.

🔴 2. Poor credit score – Improve your credit before applying by reducing debt & disputing errors.

🔴 3. Insufficient reserves – Make sure you have at least 6-12 months of reserves saved.

🔴 4. High LTV ratio – Consider putting more down to reduce lender risk.

🔴 5. Unapproved property type – Check with your lender if your property type qualifies.

DSCR Loan Approval Checklist ✅

Before applying, make sure you have:

✔ Property rental income details (lease agreements or projected market rent)

✔ Credit score of at least 660+ (higher = better rates)

✔ 20-25% down payment ready (minimum)

✔ 6-12 months of mortgage reserves saved

✔ Appraisal confirming property value & rental potential

✔ LLC documents (if buying under an LLC)

🔗 Related: Navigating Fixed-Rate Mortgages – Your Expert Guide (If you’re deciding between fixed vs. DSCR loan options)

Step-by-Step Guide to Getting a DSCR Loan

Step 1: Identify a Profitable Investment Property

- Look for high-rent areas to ensure strong cash flow.

- Use rental income calculators to estimate the DSCR before making an offer.

- Ensure the property is in good condition—fixer-uppers may not qualify.

🔹 Pro Tip: Some lenders allow short-term rental (Airbnb/VRBO) income—confirm this upfront if you’re investing in vacation rentals.

Step 2: Choose a DSCR Lender

Not all mortgage lenders offer DSCR loans. Work with a broker like First Nation Financial, who specializes in investment property financing.

✔ Compare rates, LTV limits, and reserve requirements.

✔ Ask if they allow short-term rental income or require long-term lease projections.

Step 3: Prepare Your Documents

Since DSCR loans don’t require tax returns or W-2s, your focus should be on property-related paperwork:

✔ Lease agreements (or projected rent from an appraiser if vacant)

✔ Bank statements (to verify reserves)

✔ Property appraisal (to confirm market value & rental potential)

✔ LLC documents (if buying under a business entity)

🔹 Pro Tip: Having a higher DSCR (1.25+) and strong reserves (6-12 months) can help secure better loan terms.

Step 4: Get Pre-Approved

A pre-approval letter strengthens your position when making an offer on a property. This process typically takes 24-48 hours and gives you:

✔ A clear idea of how much you qualify for

✔ A locked-in loan rate (for a set period)

✔ Leverage with sellers to negotiate better deals

Step 5: Close on the Loan & Start Earning Rental Income

Once the property is appraised and underwriting is complete, your loan will be funded, and you can start collecting rent!

🏡 Congrats! You now have an investment property that pays for itself.

📞 Want to get pre-approved? Contact First Nation Financial today! 🚀

Final Thoughts: Why DSCR Loans Are a Powerful Tool for Investors

DSCR loans remove the biggest barriers to real estate investing by allowing you to qualify based on rental income—not personal income.

🔹 Why Investors Love DSCR Loans:

✔ No W-2s, tax returns, or job verification required

✔ Faster approvals and closings (less paperwork)

✔ No limit on the number of properties financed

✔ LLC ownership allowed (for asset protection)

✔ Works for long-term rentals, multi-units, and short-term Airbnb properties

If you’re an investor, self-employed, or looking to scale your rental portfolio, a DSCR loan is one of the best financing options available today.

📞 Get Pre-Approved for a DSCR Loan Today!

At First Nation Financial, we specialize in helping real estate investors secure DSCR loans with:

✔ Competitive rates 💰

✔ Fast approvals ⚡

✔ Expert guidance every step of the way 🏡

🔹 Ready to scale your portfolio? Contact us today to get pre-approved and start building wealth through real estate!